Partly Agricultural And Partly Business Income 21+ Pages Solution in Google Sheet [1.4mb] - Updated

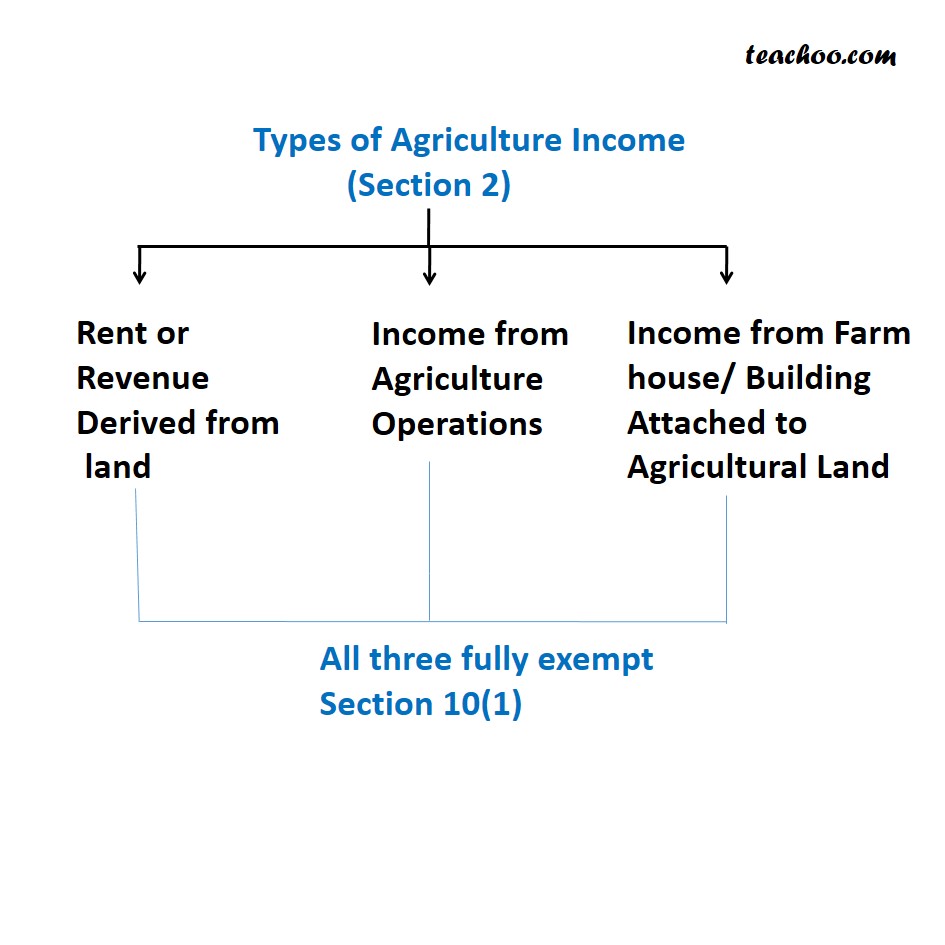

See 5+ pages partly agricultural and partly business income solution in PDF format. Section 21A of the Income Tax IT Act 1961 defines agricultural income and broadly demarcates it into three categories. In above examples growing of crops is an agricultural process because it fulfills the conditions of agricultural income. 29Agricultural income is defined under section 21A of the Income Tax Act 1961. Check also: business and partly agricultural and partly business income Please mark ne as the brainliest.

X cultivating sugar cane at the same time he has a sugar mill for making sugar by using his own sugar cane. 6Sometimes income of a person comprises of both agricultural as well as non-agricultural income.

Partly Agricultural And Partly Non Agricultural Ine 23In India agricultural income refers to income earned or revenue derived from sources that include farming land buildings on or identified with an agricultural land and commercial produce from a horticultural land.

| Topic: Some examples for partly agricultural income are given below. Partly Agricultural And Partly Non Agricultural Ine Partly Agricultural And Partly Business Income |

| Content: Explanation |

| File Format: Google Sheet |

| File size: 5mb |

| Number of Pages: 8+ pages |

| Publication Date: February 2021 |

| Open Partly Agricultural And Partly Non Agricultural Ine |

|

27Income which is partially agricultural and partially from business is calculated under Rule 7 of Income Tax Rules 1962 Income which is partially agricultural and partially from business.

20Composite income partially derived from agriculture is differentiated in the manner indicated in Rule 7 of the Act. 19Agricultural income is defined under section 21A of the Income Tax Act 1961. 4However the problem arises in taxation as to how much portion is to be treated as Agriculture and how much as non-agriculture. On the other hand they include some elements of agriculture and some those of business. 17PARTLY AGRICULTURAL INCOME Partly agricultural income consists of both the element of agriculture and business so non agricultural part of the income is taxed. The product must be produced by employing the human labour.

Agricultural Ine Analysis 1 In the case of income which is partially agricultural income as defined in section 2 and partially income chargeable to income-tax under the head Profits and gains of business in determining that.

| Topic: Profit of business other than Tea This rule applicable to agricultural produce like cotton tobacco and sugarcane etc here the Question. Agricultural Ine Analysis Partly Agricultural And Partly Business Income |

| Content: Solution |

| File Format: PDF |

| File size: 3mb |

| Number of Pages: 7+ pages |

| Publication Date: November 2017 |

| Open Agricultural Ine Analysis |

|

Rakib On Twitter Mapg Software Author Marketing Social Work Design 1In the case of income which is partially agricultural income as defined in section 2 and partially income chargeable to income-tax under the head Profits and gains of business in determining that part which is chargeable to income-tax the market value of any agricultural produce which has been raised by the.

| Topic: S7 Partly agriculture income Partly agricultural income consists of both the element of agriculture and business so non agricultural part of the income is taxed. Rakib On Twitter Mapg Software Author Marketing Social Work Design Partly Agricultural And Partly Business Income |

| Content: Analysis |

| File Format: PDF |

| File size: 1.8mb |

| Number of Pages: 23+ pages |

| Publication Date: November 2020 |

| Open Rakib On Twitter Mapg Software Author Marketing Social Work Design |

|

More Bad News For The Publishing Industry Agriculture Books Business Systems Online Book Shopg Partly agricultural income consists of both the element of agriculture and business so non agricultural part of the income is taxed.

| Topic: 9Computation of business income in cases where income is partly agricultural and partly business in nature. More Bad News For The Publishing Industry Agriculture Books Business Systems Online Book Shopg Partly Agricultural And Partly Business Income |

| Content: Synopsis |

| File Format: PDF |

| File size: 1.5mb |

| Number of Pages: 22+ pages |

| Publication Date: January 2021 |

| Open More Bad News For The Publishing Industry Agriculture Books Business Systems Online Book Shopg |

|

Create A Hologram Seal Of Authenticity Sticker For Robotic Manufactured Products Ad Seal Affili Logo Design Contest Print Designs Inspiration Logo Design 5Income from growing leaves is agricultural while making it in tea is non-agricultural income.

| Topic: X cultivating sugar cane at the same time he has a sugar mill for making sugar by using his own sugar cane Rule no. Create A Hologram Seal Of Authenticity Sticker For Robotic Manufactured Products Ad Seal Affili Logo Design Contest Print Designs Inspiration Logo Design Partly Agricultural And Partly Business Income |

| Content: Analysis |

| File Format: DOC |

| File size: 725kb |

| Number of Pages: 20+ pages |

| Publication Date: May 2019 |

| Open Create A Hologram Seal Of Authenticity Sticker For Robotic Manufactured Products Ad Seal Affili Logo Design Contest Print Designs Inspiration Logo Design |

|

Mcb Bank Millat Tractor Sign Mou For Provision Of Agri Based Credit To Farmers Under Construction Senate Farmer Profits of a sugar mill which grows its sugarcane can be cited as one of the examples.

| Topic: The product must be produced by employing the human labour. Mcb Bank Millat Tractor Sign Mou For Provision Of Agri Based Credit To Farmers Under Construction Senate Farmer Partly Agricultural And Partly Business Income |

| Content: Answer Sheet |

| File Format: Google Sheet |

| File size: 2.1mb |

| Number of Pages: 17+ pages |

| Publication Date: October 2020 |

| Open Mcb Bank Millat Tractor Sign Mou For Provision Of Agri Based Credit To Farmers Under Construction Senate Farmer |

|

Different Types Of Agricultural Ine Definition As Per Ine Tax 19Agricultural income is defined under section 21A of the Income Tax Act 1961.

| Topic: 20Composite income partially derived from agriculture is differentiated in the manner indicated in Rule 7 of the Act. Different Types Of Agricultural Ine Definition As Per Ine Tax Partly Agricultural And Partly Business Income |

| Content: Solution |

| File Format: Google Sheet |

| File size: 2.6mb |

| Number of Pages: 20+ pages |

| Publication Date: September 2018 |

| Open Different Types Of Agricultural Ine Definition As Per Ine Tax |

|

On Farming

| Topic: On Farming Partly Agricultural And Partly Business Income |

| Content: Answer Sheet |

| File Format: Google Sheet |

| File size: 1.4mb |

| Number of Pages: 8+ pages |

| Publication Date: May 2019 |

| Open On Farming |

|

Agricultural Ine Non Agricultural Ine Overview And Tax Liability

| Topic: Agricultural Ine Non Agricultural Ine Overview And Tax Liability Partly Agricultural And Partly Business Income |

| Content: Explanation |

| File Format: Google Sheet |

| File size: 2.1mb |

| Number of Pages: 50+ pages |

| Publication Date: December 2020 |

| Open Agricultural Ine Non Agricultural Ine Overview And Tax Liability |

|

On Farm Business

| Topic: On Farm Business Partly Agricultural And Partly Business Income |

| Content: Analysis |

| File Format: PDF |

| File size: 6mb |

| Number of Pages: 29+ pages |

| Publication Date: April 2019 |

| Open On Farm Business |

|

Ine Which Is Partly Agricultural Partly Business Partly Agricultu

| Topic: Ine Which Is Partly Agricultural Partly Business Partly Agricultu Partly Agricultural And Partly Business Income |

| Content: Answer |

| File Format: Google Sheet |

| File size: 1.9mb |

| Number of Pages: 17+ pages |

| Publication Date: October 2020 |

| Open Ine Which Is Partly Agricultural Partly Business Partly Agricultu |

|

Agricultural Ine Non Agricultural Ine Overview And Tax Liability

| Topic: Agricultural Ine Non Agricultural Ine Overview And Tax Liability Partly Agricultural And Partly Business Income |

| Content: Answer Sheet |

| File Format: PDF |

| File size: 1.9mb |

| Number of Pages: 35+ pages |

| Publication Date: December 2017 |

| Open Agricultural Ine Non Agricultural Ine Overview And Tax Liability |

|

Its definitely simple to prepare for partly agricultural and partly business income More bad news for the publishing industry agriculture books business systems online book shopg agricultural ine non agricultural ine overview and tax liability create a hologram seal of authenticity sticker for robotic manufactured products ad seal affili logo design contest print designs inspiration logo design agricultural ine analysis different types of agricultural ine definition as per ine tax mcb bank millat tractor sign mou for provision of agri based credit to farmers under construction senate farmer on climate change modules partly agricultural and partly non agricultural ine

No comments:

Post a Comment